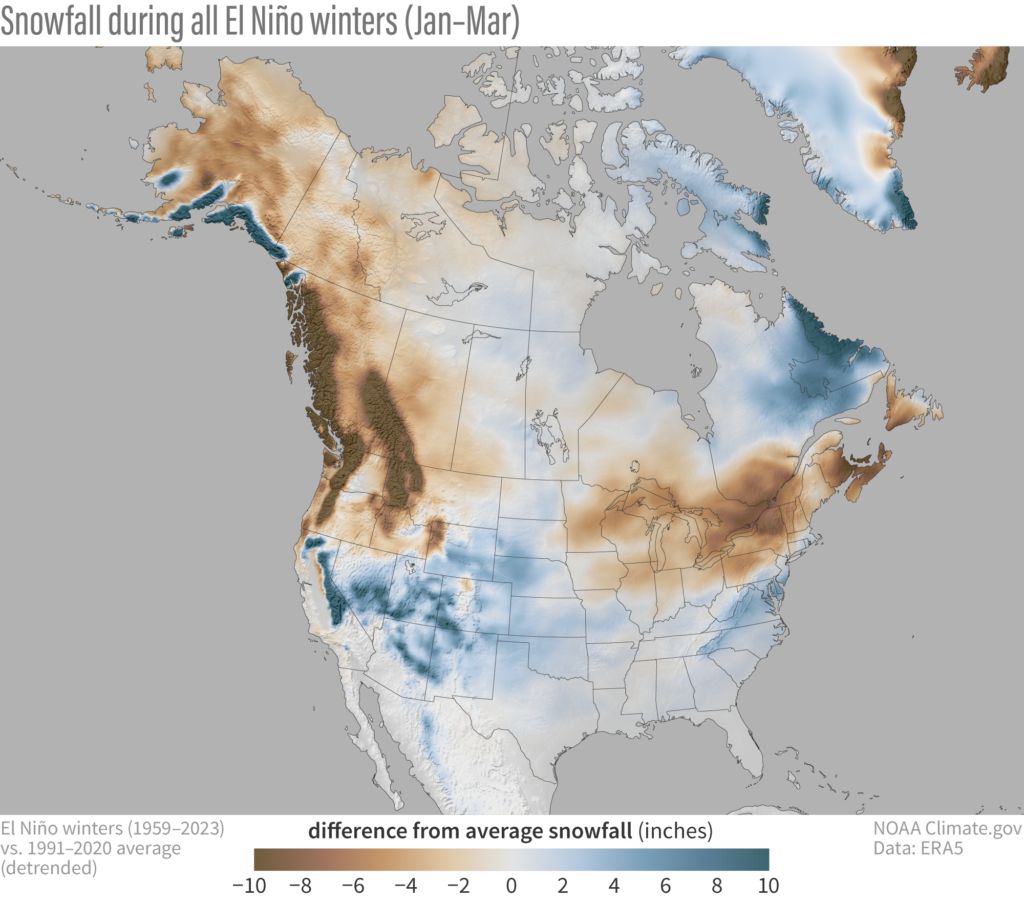

NOAA performed an analysis of snow fall patterns in the US during El Nino winters. If it holds true, we may have a heavy winter in the northern Sierras!

NOAA performed an analysis of snow fall patterns in the US during El Nino winters. If it holds true, we may have a heavy winter in the northern Sierras!

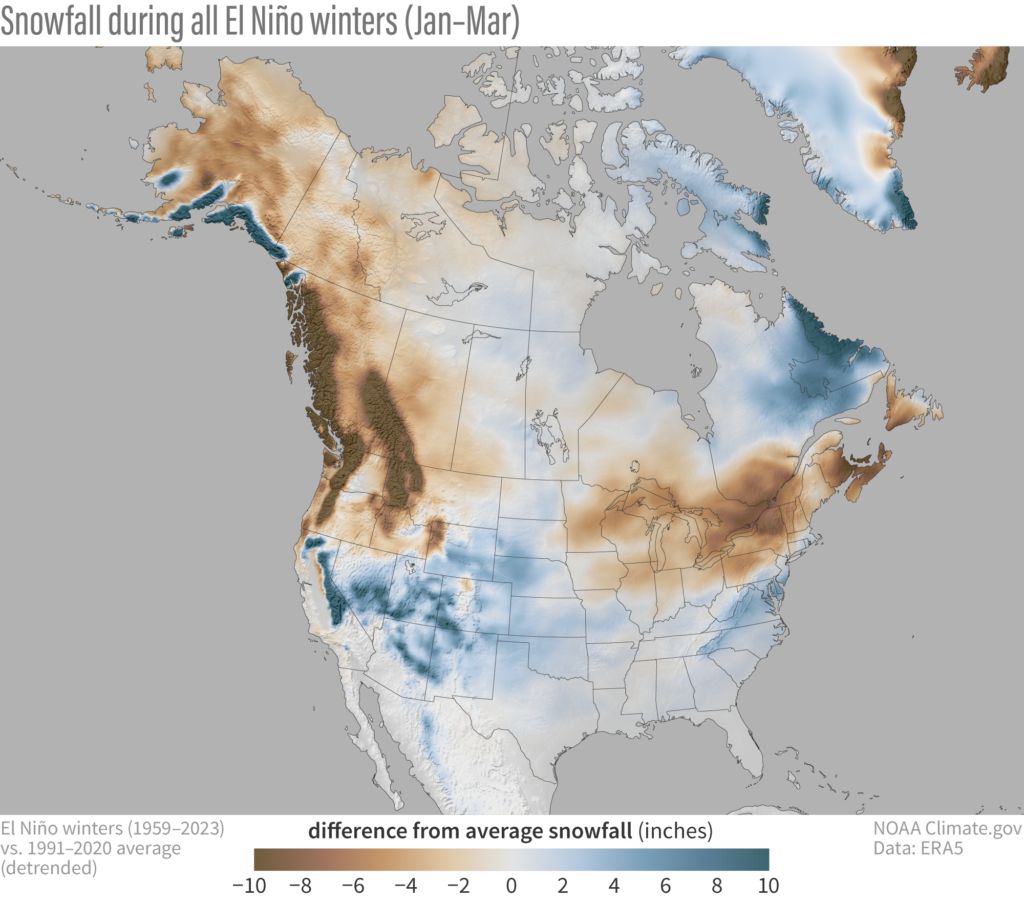

Demand for LNG has increased dramatically due to the reduction/shutdown of Russian gas shipments to Europe. This has translated into higher natural gas prices in the US. In some power markets, where natural gas is the marginal resouce, this then translates into higher spot electricity prices.

In California, the Investor-Owned Utilities are still publishing the Short Run Avoided Cost (SRAC). SRAC is roughly equivalent to a spot price and it has soared to a 12 year high this August.

While prices exceeded 10 cents/kWh in August, this isn’t a historic high. That honor belongs to the Enron energy crisis forcing spot prices all the way to 17.6 cents/kWh in January 2001.

For generators like us the bankruptcy ended well, even if the process took 17 months. The key results:

We think it is widely understood that in a bankruptcy the court has the power to abrogate contracts. We also have heard that in a recent court proceeding PGandE told the court they were working on a list of contract they want abrogated. This is serious business. There are a myriad of issues, good and bad, surrounding abrogation.

On the plus side for PGandE’s creditors, if contracts are abrogated payments for the power deliveries cease and cheaper power is substituted. This has the potential for a higher payout to PGandE’s creditors. But the abrogation may not completely take PGandE off the financial hook since the counter party can pursue a claim for lost profits. As a counter party we would much prefer to just operate under our contract rather then join the list of unsecured creditors.

But there are many negatives to abrogation starting with the chilling effect on using PPAs as the security to secure project financing. If PPAs become less effective at supporting financing the state may have a higher hurdle to met its ambitious green house gas objectives.

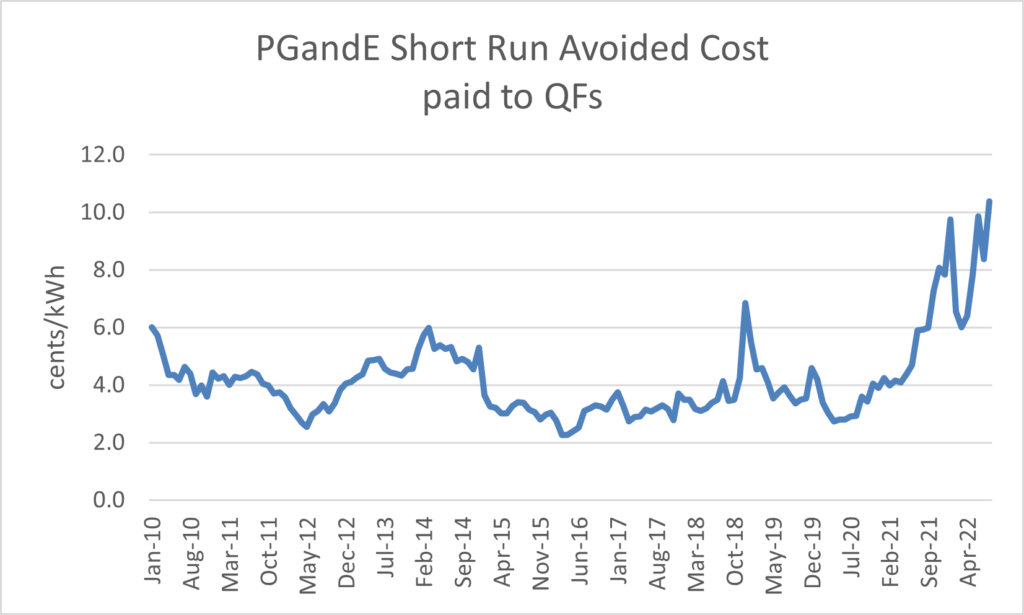

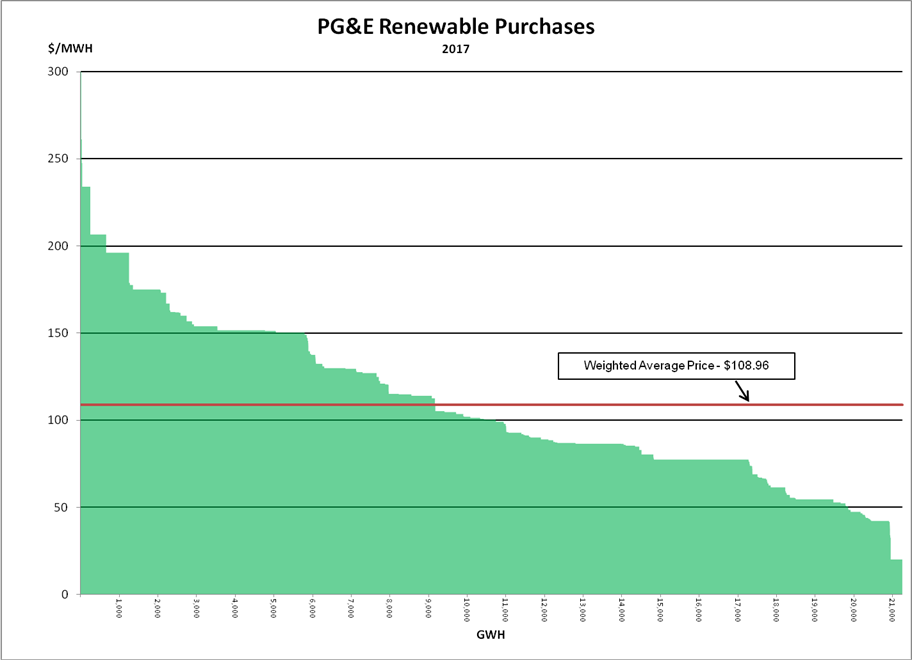

Over the past fifteen years PGandE has been directed by the CPUC to conduct a series of renewable power procurements that has resulted in a large contract portfolio. The procurement mechanism ranged from RFOs, RAMs, FiTs, ReMATs, and negotiated agreements. Of the 387 PPA (approximately according to Fong Wan, Senior Vice President of Energy Policy and Procurement atPGandE) the vast majority have resulted from CPUC directed procurements designed to meet the state’s green house gas goals.

During this period of time there have been dramatic reductions in the cost of large scale solar and wind that have driven contract prices down. So in the view of some people, the early, higher priced contracts, look to be over market.

To get a view of the “contract stack”, a business associate utilized FERC Form 1 data filed by PGandE to develop a pricing curve showing the amount of energy available in 2017 from the contracts at various price levels .

It’s apparent there is a wide range of prices that have been contracted over time. In today’s market, some of these price levels seem elevated and may become the target of the various stakeholders lining up in the bankruptcy – notably ratepayer advocates and fire victims.

Our contracts are FiT and ReMAT contracts with pricing below the weighted average. Our hope is we will be able to continue operating our renewable projects without interruption due to abrogation.

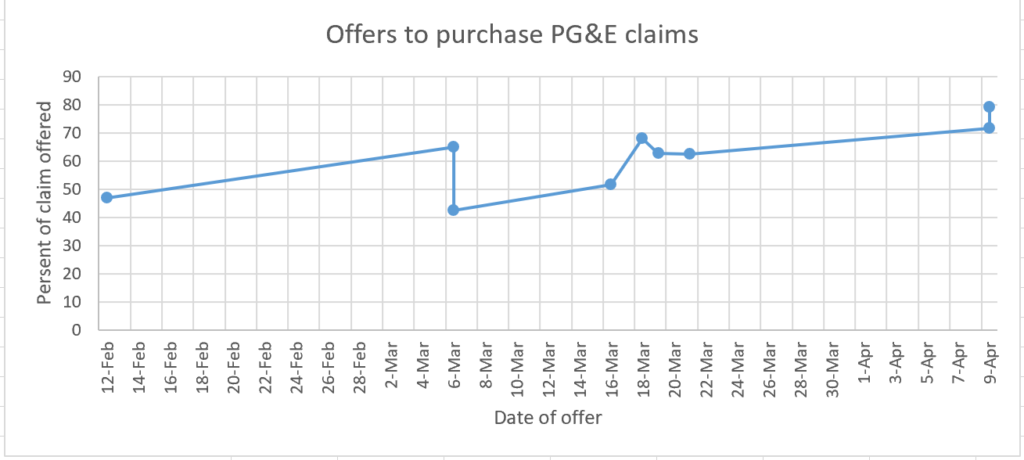

Two weeks after PG&E filed for Chapter 11 we started receiving offers from financial firms to purchase our claims against PG&E. To date we’ve had 9 offers from 6 firms. All the offers discount the claim and offer quick cash. The cash offered represents the low end of the financial firms’ estimates of recover.

For unsecured claims the best offer currently is for 71% payout. And for 503(b)(9) administrative claims the best offer is 79%. And the stock, PCG, is trading at about 40% of it’s 12 month high. Taken together, the market is not expecting PG&E shareholders or bondholders to get wiped out.

Large investor-owned utilities (IOUs) have been the vehicle of choice for the state to implement its wide ranging energy policies. In particular, the California Public Utilities Commission has implemented state renewable energy policy by requiring a series of competitive solicitations conducted by the IOUs. In total this has been a success in increasing renewable generation and in reducing its cost.

But now, major head winds are affecting the state’s policy options:

This combination of major market restructuring, and the risk that contacts might be invalidated, is dramatically changing the dynamics for the state. While for generators it’s business as usual, expect for generator produced pre-bankruptcy and not yet paid for, these uncertainties are chilling.

HAI has transferred its in-house settlement system to Powersoft for further development and marketing . The settlement system handles California’s complex ReMAT contract and is being built out to handle additional contracts and to perform a variety of project management tasks.

12 months after contract execution the Salmon Creek Hydro project went COD (contract online date) under it’s new ReMAT contract. The 12 month process required to satisfy the new ReMAT contact involved: obtaining RPS certification by the CEC, joining WREGIS, obtaining a new interconnection agreement, satisfying FERC QF requirements, joining the CAISO, and installing a new CAISO compliant meter.

This analysis looks at the development history of the small hydro segement under the previous Feed-in Tariff and the potential for new projects under the proposed ReMAT contract. It concludes that new development is unlikely under the proposed starting ReMAT price.

At the time of this power contracting analysis the Feed-in Tariff from the previous decade was no longer available and it’s replacement, now named ReMAT, was being negotiated. Ultimately some of the issues with the ReMAT contract were mitigated and it became available in late 2013 and proved successful with legacy projects.