We think it is widely understood that in a bankruptcy the court has the power to abrogate contracts. We also have heard that in a recent court proceeding PGandE told the court they were working on a list of contract they want abrogated. This is serious business. There are a myriad of issues, good and bad, surrounding abrogation.

On the plus side for PGandE’s creditors, if contracts are abrogated payments for the power deliveries cease and cheaper power is substituted. This has the potential for a higher payout to PGandE’s creditors. But the abrogation may not completely take PGandE off the financial hook since the counter party can pursue a claim for lost profits. As a counter party we would much prefer to just operate under our contract rather then join the list of unsecured creditors.

But there are many negatives to abrogation starting with the chilling effect on using PPAs as the security to secure project financing. If PPAs become less effective at supporting financing the state may have a higher hurdle to met its ambitious green house gas objectives.

Over the past fifteen years PGandE has been directed by the CPUC to conduct a series of renewable power procurements that has resulted in a large contract portfolio. The procurement mechanism ranged from RFOs, RAMs, FiTs, ReMATs, and negotiated agreements. Of the 387 PPA (approximately according to Fong Wan, Senior Vice President of Energy Policy and Procurement atPGandE) the vast majority have resulted from CPUC directed procurements designed to meet the state’s green house gas goals.

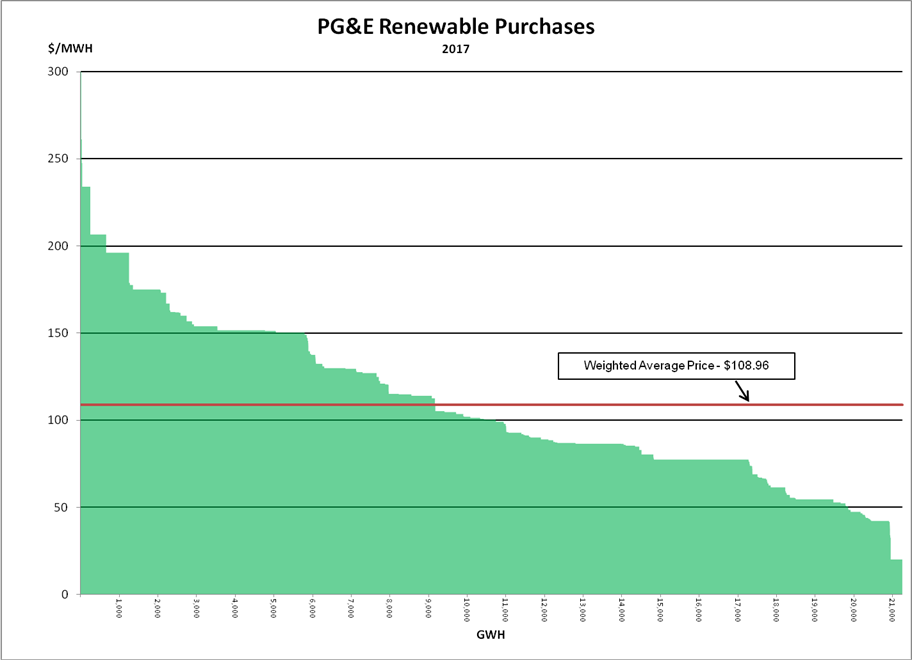

During this period of time there have been dramatic reductions in the cost of large scale solar and wind that have driven contract prices down. So in the view of some people, the early, higher priced contracts, look to be over market.

To get a view of the “contract stack”, a business associate utilized FERC Form 1 data filed by PGandE to develop a pricing curve showing the amount of energy available in 2017 from the contracts at various price levels .

It’s apparent there is a wide range of prices that have been contracted over time. In today’s market, some of these price levels seem elevated and may become the target of the various stakeholders lining up in the bankruptcy – notably ratepayer advocates and fire victims.

Our contracts are FiT and ReMAT contracts with pricing below the weighted average. Our hope is we will be able to continue operating our renewable projects without interruption due to abrogation.